Drywall Repair

If you have a property that the sewer line constantly backs up

from roots or whatever… or maybe have one of those ALIEN tenants?

You may want to take look at this! Could save a major indoor cleanup.

You can get one here or I’m sure other places. Just google it.

Written by Elizabeth McGrath

Updated 11/03/19

:max_bytes(150000):strip_icc():format(webp)/male-finger-turning-up-tankless-water-heater-temperature-184876582-5800e48f5f9b5805c2b59032.jpg)

Your water heater is a workhorse appliance that works nearly constantly. Not only does every faucet in your house depend on the water heater, but so do appliances such as the clothes washer and dishwasher. Like any hardworking appliance, the water heater is subject to a variety of maintenance issues and common problems, but one of the most common complaints is that it doesn’t produce enough hot water.

The first residential hot water heater was made in England in 1868. It worked by flowing cold water through pipes exposed to a hot gas burner; the heated water would then flow into a sink or tub.

Here are some things to look for when your water heater doesn’t provide enough hot water, with suggestions on how to address the problem.

Perhaps the most common reason for an inadequate supply of hot water is that there are too many fixtures and appliances drawing hot water for the water heater to keep up with the demand. If the problem has just appeared, some reasons why your hot water supply might be inadequate include the following:

In cold-climate areas, the incoming water supply can be very, very cold in the wintertime, which means your water heater will require considerably more time to heat the water. As a result, you may feel that you’re not getting the same volume of hot water as before.

Increase the thermostat temperature setting on your water heater during the winter months. This will partially compensate for the colder water entering the tank at this time of year.

It is the incoming cold water flow that pushes the hot water out to fixtures and appliances. If the water supply experiences a reduction in water pressure, this will also reduce the pressure at which hot water is forced out of the tank, making it seem like you don’t have as much hot water.

Fixing water pressure problems can be difficult because there can be several causes. In some instances, old, corroded pipes may need to be replaced with new plumbing pipes. If your home has a water pressure regulator valve, this device may need adjustment or replacement.

In the interest of energy savings and home safety, many people set the thermostat on the water heater at a fairly modest 120 F. This is good practice, but it also means that you may be running a shower or sink faucet at the full hot position in order to get the hot water you need. This can quickly empty a water heater during peak-use times.

Set the thermostat higher—at 140 F or higher. At this setting, getting comfortably warm water at a shower or faucet will involve mixing the hot and cold water flow, which means it will take longer to use up the hot water in the tank.

If you notice no increase in water temperature when you increase the setting on your water heater, it’s possible that the thermostat is faulty. This is fairly common with electric water heaters, which have thermostats attached to both the upper and lower heating elements on the tank.

You should have the faulty thermostat replaced.

Electric water heaters have two heating elements mounted in the tank, and it is fairly common for them to wear out. Diagnosing a heating element is fairly easy. A constant supply of lukewarm water usually means a defective upper heating element, while a short-lived supply of fully hot water means that the lower heating element is probably defective.

Test and replace a faulty element. This is a fairly easy DIY project.

If rust, corrosion, and sediment build-up in the bottom of a water heater tank, the burner or heating elements will not heat the water as efficiently, making it harder to maintain a good supply of sufficiently hot water.

Prevention—in the form of yearly flushing of the water heater tank to remove any buildup of sediment and rust that collects in the bottom of the tank.

In homes where a bathroom is quite some distance away from the water heater, it can not only take quite a while for hot water to reach the shower and sink faucet, but the hot water supply may run out rather quickly. The reason for this is that a considerable amount of hot water is being used to heat up long runs of pipes running from the water heater to the faucets.

There are several solutions to consider:

Hot water heaters are designed so that cold water enters the tank through a dip tube that runs from top cold water inlet down through the inside of the tank, delivering the cold water to the bottom. This ensures that the hottest water is at the top of the tank, near the hot water outlet pipe.

If the dip tube becomes disconnected or broken, the cold water may enter the tank at the top, where it immediately dilutes the hot water. This results in lukewarm water and an apparent reduction in the volume of hot water.

Disconnect the cold water inlet on the water heater, remove the old dip tube, and install a new dip tube. The part is inexpensive, and replacement is an easy DIY project.

A gas water heater cannot heat effectively if the burner is dirty or not functioning properly. The gas flame at the burner should burn steadily with a bright blue flame. If the flame is irregular or yellow in color, it will not be as hot and won’t heat up the water in the tank as effectively.

Service the gas burner, which usually means cleaning the jets so the gas can flow freely. If the burner is cracked or badly corroded, it should be replaced.

The average lifespan of a water heater is 8 to 12 years, and no matter how well you maintain it, eventually sediment will build up, affecting the efficiency of the appliance and reducing the available volume for hot water. If your water heater is at least 10 years old, efforts to correct a diminishing supply of hot water may be futile.

An old water heater needs to be replaced. When choosing a new water heater, make sure to choose a model with a tank size large enough for your needs. And now might be a time to consider a state-of-the-art tankless water heater.

Article From www.thespruce.com

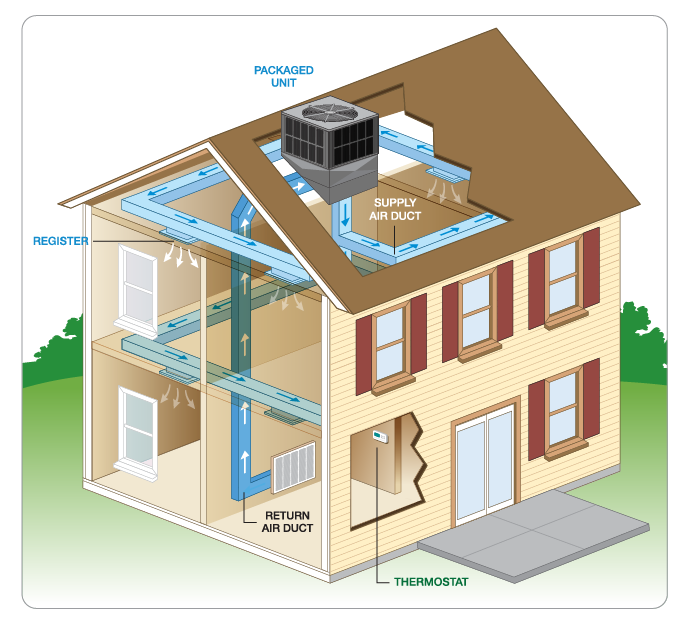

Packaged Air Conditioners : The compressor, coils, air handler are all housed in a single-boxed cabinet. The packaged air conditioner can also provide limited warmth by using an electrical strip heating.

Operation depends on configuration, but packaged systems typically heat and cool your home the same way their stand-alone counterparts do. The ducting with a single cabinet system is slightly different. The duct work is attached to the system rather than connecting to various components in your home.

From https://www.goodmanmfg.com/resources/heating-cooling-101/how-a-packaged-system-works

| MONTHLY MANAGEMENT TIPS FROM MRLANDLORD.COM (Shared by landlords nationwide) THE BEST LANDLORDING ADVICE I’VE RECEIVED 10 rental property owners share what they believe is the single best piece of landlording advice that they have ever received. Here are their school of hard knocks words of wisdom: 1) Like Reagan said, “Trust but verify”. 2) Treat residents well! 3) Hang out with like-minded people. Ask to shadow a successful landlord in your area. 4) Don’t underestimate the actual cost of owning real estate! Many studies indicate total expenses including vacancy, etc. will average around 45% to 50% of gross income. 5) Compared to a bad resident, a vacancy is a delight. 6) Put your rental criteria in writing. 7) Figure out who you want to rent to and only buy/fix properties they will rent. 8) The landlord is in charge. The resident is not! 9) Make sure you have a fantastic lease that covers everything – Everything! 10) Five years from now YOU WILL BE the books you read, the audios you listen to, and the people you associate with. Wealth creation is between the ears. 12 STEPS FOR ONE DAY TURNOVER Many of you veterans out there may already know all of this, but just in case I wanted to share “the system” that has one landlord 3 for 3 of his last vacancies at a one day turn over. Step 1: Communication with current residents. Make sure you touch base with resident 90 days out from their anniversary date about which anniversary gift they want. If I hear nothing by 60 days out, then we ask again or confirm their intent to move. Repeat this step 30 days out. Get their desire in writing, signed, and dated! Step 2: Start advertising. I start putting my Craigslist & Zillow ad 30 days out, around the first of the month. Renew the post every 2 days or as often as allowed. Step 3: Communicate my bonus program to the current residents. $100 if they bring me a qualified prospect who signs a lease (and pays!). Or $100 if I get someone with their assistance prior to their move out to pre-lease. This moving bonus is a thank you for them keeping the place nice enough to show and being accommodating to repeat showings, plus saying a positive word about the home or neighborhood. Yeah, my lease says they have to do it anyway for free BUT this encourages cooperation and they say nice things about me to the prospect too! Step 4: Get a “anytime is fine” showing agreement with residents. Basically, anytime between X and Y times it’s okay for me to show the rental with 30 minutes notice ahead of time. Or get them to agree to show it for you when they’re home. Saves gas, saves time, and it’s less stress. Step 5: While doing showings, make the handyman provide a fix-it list for repairs as soon as the old residents are in their last weeks before moving out. Step 6: One week out, line up your cleaning / maintenance / carpet-scrubbing crew(s). Coordinate so they aren’t stepping on each other to get it done the day resident moves out, if possible. If all else fails and its a fairly clean turnover, you can probably leave the maintenance for last unless there’s a major issue that affects habitability. The cleaning gal shows up in the morning, carpet scrubbers finish up in the evening. The next day everything is dry and ready for new resident. Step 7: Email the lease as an attachment to resident 3 days prior to signing to ensure they have ample time to review and ask questions. Remind them that you need the rent and deposit in certified funds (no personal checks, thank you) when you meet to sign the lease. No money, no keys, no signing anything. Step 8: Day prior to lease begins. Make sure utilities are switched over effective the day prior to the first day of the lease. Call the power company or ask the resident to show you a receipt as proof of service. Step 9: Day lease begins. Do walk through with residents. Note deficiencies and write down everything you agree to fix / repair / upgrade on a list that says: “Only these items will be fixed / repaired / upgraded. RESIDENT agrees landlord has not promised, verbally or in writing, to any other repairs, fixes or upgrades that are not listed. Premises are accepted in “as is” condition, unless otherwise noted on this sheet.” Step 10a: Get money, sign lease. Give resident a run down of rules and procedures for maintenance requests and emergency contact information. Show them where the circuit breaker box is, water shut off, etc. Give each resident a copy of your business card (with you as property manager) with phone number, office hours and email address. Step 10b: Hand over keys. (this is last for a reason, folks!) Step 11: Deposit money in your bank. Step 12: Go enjoy a cold beverage of your choice in celebration. Ah, another turn over complete! Of course there will be some turn-overs that are more complex: eviction, slobs, damages, etc. This is meant as a basic blue print for an otherwise successful tenancy that is coming to a close. Add or subtract steps that you feel make the process smoother. The tips in this column are shared by regular contributors to the popular MrLandlord.com Q&A forum, by real estate authors and by Jeffrey Taylor, Founder@Mrlandlord.com. To receive a free sample of Mr. Landlord newsletter, call 1-800-950-2250 or visit their informative Q&A Forum at LandlordingAdvice.com, where you can ask landlording questions and seek advice of other landlords 24 hours a day. “Management tips provided by landlords on MrLandlord.com. To receive a free Rental Owner newsletter, call 1-800-950-2250 or visit our nationwide Q&A Forum, LandlordingAdvice.com, where you can ask landlording questions and seek the advice of other rental owners 24 hours a day.” |

| MrLandlord.com, All the Keys to Landlording Success, Box 64442, Virginia Beach, VA 23467 |

Come One, Come All!!

Come join us and learn the basics of real estate investing. We

cover flipping, landlording and most especially how to buy the

right way and not overspend.

We have prepared the classes to take in order to earn the

Professional Housing Provider designation developed by the

National Real Estate Investor Association.

Classes will be taught by experts in their fields and as a bonus

they are fellow AIA members and/or sponsors. (AIA members

get a discount)

So, come join your fellow investors and learn how to start

investing successfully!

PHP program – $1,150 full price

$ 950 for AIA members

For a married couple – one spouse pays 50%

For two business partners – one partner pays 75%

THE PROFESSIONAL HOUSING PROVIDER PROGRAM

Presented by AIA/ALREIA

Twenty classes will be offered of 3 hours each for a total program length

of 60 hours as required by the National REIA. Classes will meet on

Tuesdays and Thursdays from 6-9PM at the New Vocation Realty School

at 2017 Canyon Road Suite 45 Vestavia Hills, AL 35216. Classes will be

recorded in order to assist the students in completing the program.

TOPICS INCLUDE:

BUYING RIGHT

SELLING PROFITABLY

REHABBING

LANDLORDING

APPRAISAL

PURCHASING

NEGOTIATION

TAXES

INSURANCE

CONTRACTS/LEASES

MARKETING

FINANCING

FAIR HOUSING

INSPECTIONS

MANAGEMENT

FED & LOCAL REGS

ETHICS

&

15 HOURS OF STUDENT

CHOSEN ELECTIVES

Chuck Robertson has been teaching

Real Estate for several years and

coordinated the PHP program the last

time it was offered. He has been a real

estate appraiser for 19 years and got

his broker’s license in 2005. He

currently serves as President of the

Alabama Real Estate Educators

Association. Chuck has been a

member of AIA for over ten years.

To Signup, please contact...