Drywall Repair

If you have a property that the sewer line constantly backs up

from roots or whatever… or maybe have one of those ALIEN tenants?

You may want to take look at this! Could save a major indoor cleanup.

You can get one here or I’m sure other places. Just google it.

Written by Elizabeth McGrath

Updated 11/03/19

:max_bytes(150000):strip_icc():format(webp)/male-finger-turning-up-tankless-water-heater-temperature-184876582-5800e48f5f9b5805c2b59032.jpg)

Your water heater is a workhorse appliance that works nearly constantly. Not only does every faucet in your house depend on the water heater, but so do appliances such as the clothes washer and dishwasher. Like any hardworking appliance, the water heater is subject to a variety of maintenance issues and common problems, but one of the most common complaints is that it doesn’t produce enough hot water.

The first residential hot water heater was made in England in 1868. It worked by flowing cold water through pipes exposed to a hot gas burner; the heated water would then flow into a sink or tub.

Here are some things to look for when your water heater doesn’t provide enough hot water, with suggestions on how to address the problem.

Perhaps the most common reason for an inadequate supply of hot water is that there are too many fixtures and appliances drawing hot water for the water heater to keep up with the demand. If the problem has just appeared, some reasons why your hot water supply might be inadequate include the following:

In cold-climate areas, the incoming water supply can be very, very cold in the wintertime, which means your water heater will require considerably more time to heat the water. As a result, you may feel that you’re not getting the same volume of hot water as before.

Increase the thermostat temperature setting on your water heater during the winter months. This will partially compensate for the colder water entering the tank at this time of year.

It is the incoming cold water flow that pushes the hot water out to fixtures and appliances. If the water supply experiences a reduction in water pressure, this will also reduce the pressure at which hot water is forced out of the tank, making it seem like you don’t have as much hot water.

Fixing water pressure problems can be difficult because there can be several causes. In some instances, old, corroded pipes may need to be replaced with new plumbing pipes. If your home has a water pressure regulator valve, this device may need adjustment or replacement.

In the interest of energy savings and home safety, many people set the thermostat on the water heater at a fairly modest 120 F. This is good practice, but it also means that you may be running a shower or sink faucet at the full hot position in order to get the hot water you need. This can quickly empty a water heater during peak-use times.

Set the thermostat higher—at 140 F or higher. At this setting, getting comfortably warm water at a shower or faucet will involve mixing the hot and cold water flow, which means it will take longer to use up the hot water in the tank.

If you notice no increase in water temperature when you increase the setting on your water heater, it’s possible that the thermostat is faulty. This is fairly common with electric water heaters, which have thermostats attached to both the upper and lower heating elements on the tank.

You should have the faulty thermostat replaced.

Electric water heaters have two heating elements mounted in the tank, and it is fairly common for them to wear out. Diagnosing a heating element is fairly easy. A constant supply of lukewarm water usually means a defective upper heating element, while a short-lived supply of fully hot water means that the lower heating element is probably defective.

Test and replace a faulty element. This is a fairly easy DIY project.

If rust, corrosion, and sediment build-up in the bottom of a water heater tank, the burner or heating elements will not heat the water as efficiently, making it harder to maintain a good supply of sufficiently hot water.

Prevention—in the form of yearly flushing of the water heater tank to remove any buildup of sediment and rust that collects in the bottom of the tank.

In homes where a bathroom is quite some distance away from the water heater, it can not only take quite a while for hot water to reach the shower and sink faucet, but the hot water supply may run out rather quickly. The reason for this is that a considerable amount of hot water is being used to heat up long runs of pipes running from the water heater to the faucets.

There are several solutions to consider:

Hot water heaters are designed so that cold water enters the tank through a dip tube that runs from top cold water inlet down through the inside of the tank, delivering the cold water to the bottom. This ensures that the hottest water is at the top of the tank, near the hot water outlet pipe.

If the dip tube becomes disconnected or broken, the cold water may enter the tank at the top, where it immediately dilutes the hot water. This results in lukewarm water and an apparent reduction in the volume of hot water.

Disconnect the cold water inlet on the water heater, remove the old dip tube, and install a new dip tube. The part is inexpensive, and replacement is an easy DIY project.

A gas water heater cannot heat effectively if the burner is dirty or not functioning properly. The gas flame at the burner should burn steadily with a bright blue flame. If the flame is irregular or yellow in color, it will not be as hot and won’t heat up the water in the tank as effectively.

Service the gas burner, which usually means cleaning the jets so the gas can flow freely. If the burner is cracked or badly corroded, it should be replaced.

The average lifespan of a water heater is 8 to 12 years, and no matter how well you maintain it, eventually sediment will build up, affecting the efficiency of the appliance and reducing the available volume for hot water. If your water heater is at least 10 years old, efforts to correct a diminishing supply of hot water may be futile.

An old water heater needs to be replaced. When choosing a new water heater, make sure to choose a model with a tank size large enough for your needs. And now might be a time to consider a state-of-the-art tankless water heater.

Article From www.thespruce.com

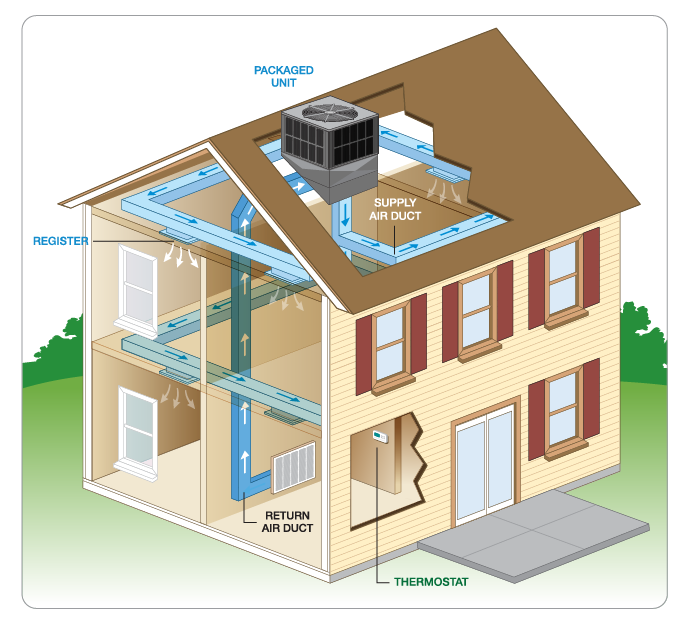

Packaged Air Conditioners : The compressor, coils, air handler are all housed in a single-boxed cabinet. The packaged air conditioner can also provide limited warmth by using an electrical strip heating.

Operation depends on configuration, but packaged systems typically heat and cool your home the same way their stand-alone counterparts do. The ducting with a single cabinet system is slightly different. The duct work is attached to the system rather than connecting to various components in your home.

From https://www.goodmanmfg.com/resources/heating-cooling-101/how-a-packaged-system-works

I hear people giving financial advice all the time. Most of them aren’t rich.

Those who are rich would disagree with what many charlatans preach. The other day, I came across an article proclaiming, “Skip your lunch, don’t buy expensive coffee, cut your hair less often.” This is a horrendous way to live your life and it promotes poverty. It’s smart to be thrifty, but you don’t want to be cheap. You should never do anything that will deprive you from your joy.

I promote prosperity–and taking away these simple pleasures will not make you rich. It will drive you to be more frustrated from these unrealistic disciplines. Most of these hypocrites who profess these antics haven’t even made it financially. They just sit at a keyboard in a delusional manner, waiting for a payday that often never happens.

Financial advice is freely given by most people, but most of it is horrible. Conversely, the words you are currently reading are written by someone who is a self-made millionaire. Therefore, watch whom you learn from, for it is in your best interest (pun intended).

If you’re naturally a hard worker with a great career and have been diligent in all your affairs, you can have prosperity now. However, you might be asking, “Why haven’t I made it yet?” The answer to this question is in the way you think, feel, and act toward your money. Making better choices with your money can turn your life around.

There are certain financial mistakes that rich people never make. The journey in becoming rich will require you to make a few mental changes in your behaviors. Once you make these adjustments, you will begin to see the progress as your create more positive results in your life. Acquiring wealth is a great goal, but who you become in the process is even more worthwhile.

Here are 10 financial mistakes rich people never make:

America’s first millionaire, Benjamin Franklin, was known for saying, “An investment in yourself pays the best interest.” Often, people depend on their employers to buy them books, send them to seminars, or provide them with coaching. However, you must take your education into your own hands if you want to prosper. Invest in yourself.

Related: 7 Networking Tips From a Real Millionaire

Yesterday, I popped into a local Dave and Buster’s to see the grand opening. It was crowded with hundreds of young adults (ages 21-35) who were wasting precious time and money. Most people spend 30-50 percent of their paychecks on entertainment, while they temporarily escape the realities of life. Instead, rich people use that time and money to fund their dreams.

Many people purchase objects they can’t afford with money they don’t have to impress people they don’t like. This tragedy decimates many people, leaving them with a hopeless feeling when they repay their high-interest loans. If a person hopes to become rich, they will use their credit cards for growing and promoting their business, not funding personal expenditures.

Millions of married couples don’t talk about money. It makes them uncomfortable, which sometimes leads to arguments. However, you cannot get rich unless you disclose your financial precepts with your spouse. Money is only multiplied when love is in the mix and both members of the household have a clear understanding about their finances.

Some “rich” people mortgage their homes, but they aren’t really rich. Mortgaging your home leads to an endless battle of re-financing, bill-paying, and inflation. When you mortgage a home, you’re likely to pay twice as much asthe original price! Rich people rent until they can buy their house with straight cash, like I did.

Our retirement system is a joke that must be evaded by those who want to become rich. If you’re depending on mutual funds, 401(k), and certain life-insurance policies, you’ll do better boarding the Titanic. Plus, if you’re saving money to enjoy it for your sixties, that’s like saving up sex for retirement! Instead, build your fortune while you are young.

Related: 10 Questions Every Aspiring Millionaire Should Ask

Price shoppers and coupon clippers will hate this, but when you buy shoddy goods, you get shoddy results. If you live by the price, you die by the price. Instead of buying what is “cheap,” buy the best goods that are available. Rich people know that buying a $40 shirt which will last for four years is better than buying a $10 shirt that must be replaced every year.

Consumerism is funny. During 50 weeks at work, people think about vacations and when they finally get their two weeks, they only think about work. The truth about becoming rich is that you must enjoy the money that you already have, whether it’s $10 or $100. Your money will only expand if you appreciate it and think about how you can enjoy it more. You’ll always get more of what you enjoy.

Most people blow their money on miscellaneous goods. When they see ‘X’ amount in their bank account, they automatically think of what they “need” and purchase it immediately. However, this impulsive behavior must be eliminated. Rich people save at least 10 percent of what they earn and rarely take out personal loans for themselves, even if they think they need it. Save.

The majority of people in this world work for money, but rich people let money work for them. They know that their money will be a byproduct of the service that they render to the marketplace. Rich people also acknowledge the fact that their material wealth is the sum total of their entire contribution to society. That’s why they never work for money.

Making these mental shifts can dramatically alter your life. When you start changing your financial habits and avoiding these mistakes, you will be on your path to be rich. Remember, it’s not what you acquire that makes you rich, but who you become in the journey. And of course, I hope to be your neighbor one day; maybe I’ll invite you to my home!

reprinted from http://www.entrepreneur.com

Related: 7 Tips to Becoming a Millionaire

Please check out all the info has Brian has provided on the New Alabama LLC’s, Landlording and more!

JULY 4th 2014 ARCHIE PHILLIPS & DOYLE ROSSER founders of AIA Alabama Real Estate Investors Association 35 years ago in 1978, AIA members enjoyed Archies BBQ at his Lake in Columbiana today. See Archies and his wifes photo – he is 78 yrs. old and recovering from sickness. These two individuals mean a lot to AIA and we thank them for all the work they have done on behalf of the association and the countless number of investors they have educated, mentored and coached to a better way of life through Real Estate Investing. Six County Commissioners, and Congress individuals showed up today to honor ARCHIE. Archie serves today as our Governmental Affairs Chairperson- he is by far our most politically connected person and influence! His son Bubba serves along side of him plus other individuals.